Scam Alert – Protect Yourself from Text and Phone Scams

DON’T BE FOOLED

Enterprise Bank of SC will never ask for personal or financial information (such as usernames, passwords, PINs, or debit card numbers) by text message, email, or phone call.

Recently, scammers have been spoofing the phone numbers of legitimate businesses, including banks, to trick customers into revealing personal or account information. These messages and calls do not come from Enterprise Bank of SC and are designed to steal your information.

Phone Spoofing (Fake Caller ID)

Scammers may falsify the number or name shown on Caller ID to make it look like the call is coming from a trusted source. Their goal is to pressure you into giving out information or taking immediate action.

Remember:

-

Caller ID is not a reliable way to verify who’s calling.

-

Enterprise Bank of SC will never call you to request personal or account information, verification codes, or passwords.

-

If you receive a suspicious call claiming to be from the Bank, hang up immediately and call us back using the official number on our website or your account materials.

-

Do not provide any personal information or follow any instructions from suspicious callers.

If you believe you may have disclosed information to a scam caller, contact us right away. We will secure your accounts and close or reissue any potentially compromised debit cards.

Text Message Scams (Phishing Texts)

Scammers are also sending fake text messages that often reference “fraud” on a debit card to create a sense of urgency. These messages are designed to trick you into clicking links or providing personal information.

Important Facts:

-

Enterprise Bank of SC does send legitimate fraud-alert texts when suspicious debit card activity is detected, but those messages will never ask for personal information or include links.

-

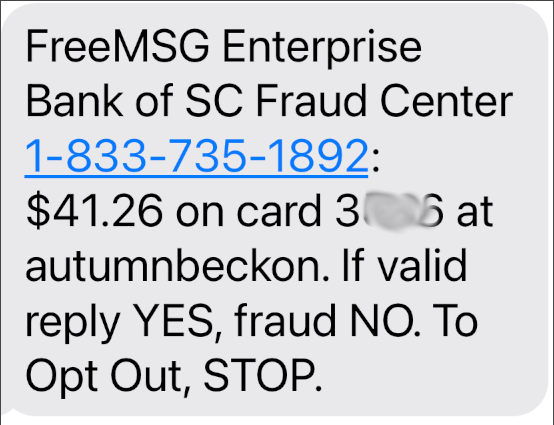

Legitimate alerts will reference a specific transaction, amount, and debit card, and will only ask for a simple “YES” or “NO” response to confirm or deny the transaction.

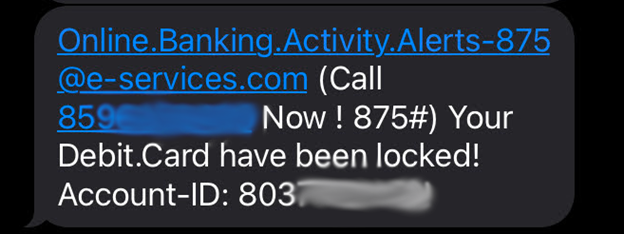

Fraudulent Text Example:

Legitimate Fraud Alert Example:

How to best protect yourself:

-

Protect yourself from Caller ID spoofing:

-

Be skeptical of any unexpected calls requesting personal or financial information—even if the number looks familiar or matches a legitimate business.

-

Hang up and call back using the official number listed on the company’s website or your account materials.

-

Consider using call-filtering or spam-blocking apps available through your mobile carrier or smartphone app store.

-

Report repeated spoofed calls to your phone carrier and the Federal Communications Commission (FCC).

-

-

Protect yourself from phishing text messages:

-

Use our free EBSC Mobiliti App with Card Controls to monitor your debit cards in real time. You can enable or disable your cards instantly and review all transactions.

-

Don’t be rushed. Scammers rely on urgency to make you act without thinking.

-

Never click on links in unsolicited text messages. They may contain malware or phishing websites.

-

Don’t respond to phishing messages, even to ask them to stop. It confirms your number is active.

-

Use caution when entering your cell number online or in “free trial” offers.

-

Apply the same safety habits on your phone that you use on your computer: keep software updated and be cautious with unknown senders.

-

If you receive a suspicious call or text message, you can report it to the Federal Trade Commission. See the FTC website for more information on reporting these type of scams.

Stay Vigilant

Your awareness is your best defense. Enterprise Bank of SC is committed to protecting our customers from fraud. Together, we can help stop these scams.